Rewriting the Playbook: CreditNinja’s Path to AI- First Growth

Building on Fundamentals, Pioneering What’s Next

With SearchTides, CreditNinja evolved from traditional channels to AI-powered visibility: hitting 2025 loan goals months ahead of schedule.

About Valveman

CreditNinja is a digital lending platform competing in one of the most regulated (and most competitive) spaces in the U.S. financial sector. In consumer finance, visibility isn’t optional: if customers can’t find you, they’ll turn to better-known brands or affiliates backed by publishing giants like Forbes and LendingTree.

For Patrick Shipman, Director of Digital Marketing at CreditNinja, the stakes were clear. “We operate in a space where if you’re not visible, you don’t exist,” he explains. “And we’re not just competing against peers in lending. We’re competing against massive sites with enormous authority.”

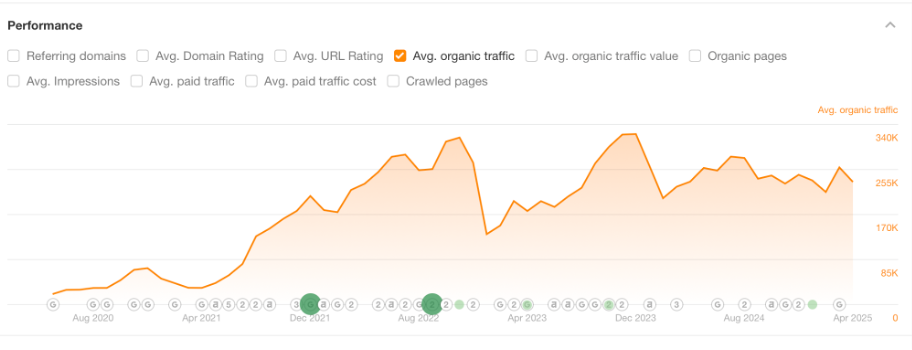

That pressure made CreditNinja’s long-term partnership with SearchTides mission-critical. Since 2019, the two teams have worked together to evolve CreditNinja’s approach to growth: starting with traditional marketing and steadily advancing into the new frontier of AI-first visibility.

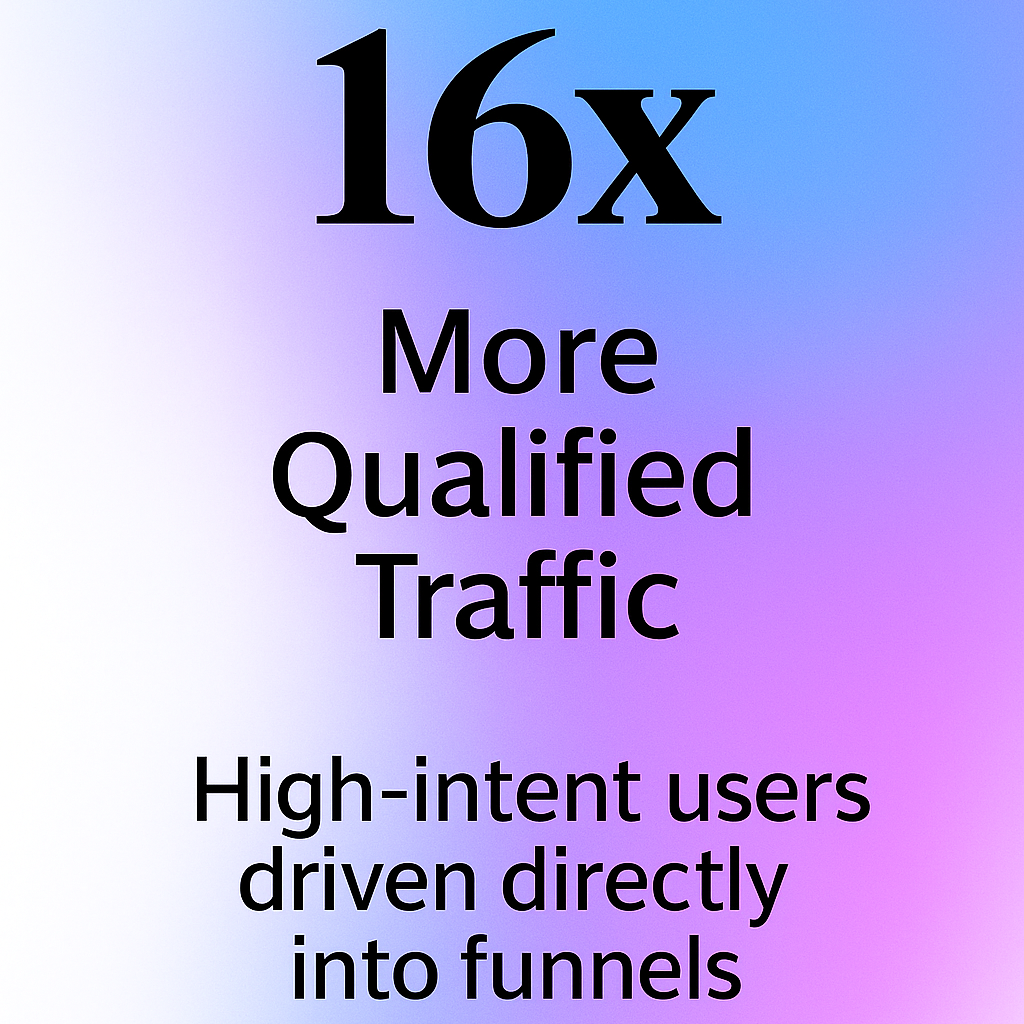

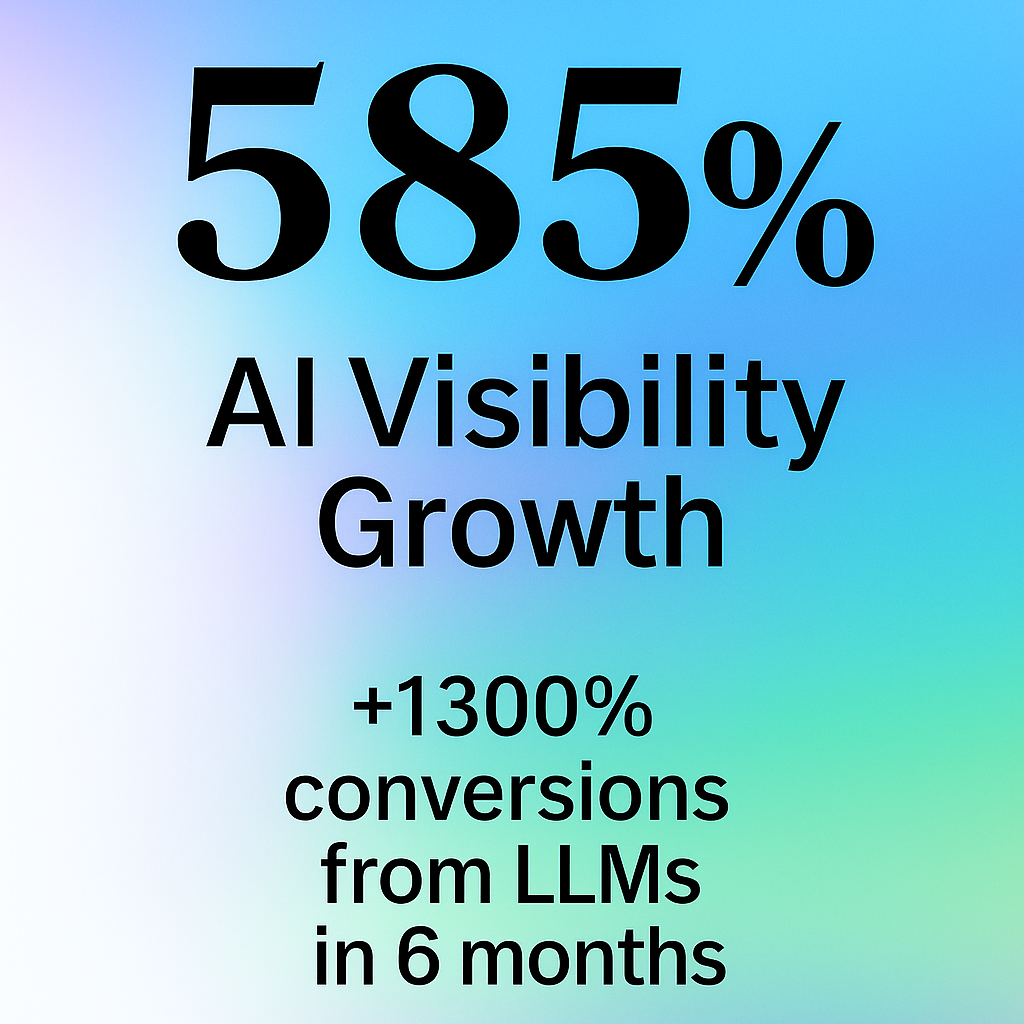

TL;DR Stats

SearchTides first came on board in April 2019. Six years later, the relationship has only deepened. Shipman doesn’t describe them as a vendor, but as an extension of his team.

“I don’t see you guys as a vendor. You’re in our Slack, I have your personal numbers. If anything comes up, we can have honest discussions. This is a true partnership”, says Patrick.

That tight integration has allowed both sides to move faster. The CreditNinja team knows that when SearchTides proposes something new, it comes from shared trust, not from an outsider trying to sell them something. “We’ve had the same faces on our account for years,” Shipman adds. “That consistency says a lot about how SearchTides operates as an organization. And it makes it easy for us to operate as one team.”

Building on Fundamentals, Pioneering What’s Next

Experimentation and trend prediction as a foundation of partnership

The early partnership centered around traditional SEO: fixing technical debt, building backlinks, and navigating the strict compliance rules of financial services marketing. But the real differentiator has been SearchTides’ push into what Patrick calls “ahead-of-the-curve” work.

“We don’t lose track of fundamentals, but we experiment way before the market has even heard of them.”

An Early Shift to AI

In one such initiative, SearchTides recommended overhauling 800+ pages on CreditNinja’s site based on a framework they had developed internally to increase the likelihood of being visible in AI LLMs.

“We debated whether it would be worth it, how long it would take, and in the end, we trusted the process. It paid off in a big way” as channel revenue jumped by more than 200% after the changes.

“What SearchTides was testing last year is now regarded as best practice,” Shipman says. “We’ve been ahead of the game, and that’s due to SearchTides pushing us forward, pioneering what’s next in brand visibility.”

How CreditNinja Hit Their 2025 Goals 4 Months Early

In August 2025, CreditNinja hit its annual loan funding target more than four months ahead of schedule.

The impact of those initiatives has been felt at the highest levels of the business. In August 2025, CreditNinja hit its annual loan funding target more than four months ahead of schedule.

“To my surprise, we hit our 2025 goal literally this week,” says Shipman. “Everything else this year is icing on the cake, due largely in part to the hard work SearchTides has done and the push into AI visibility.”

Instead of scrambling to meet quotas, the CreditNinja team entered the back half of the year in growth mode, with confidence that their AI visibility strategy was a driver of real results.

Competing with Giants

Alongside and Above Industry Titans

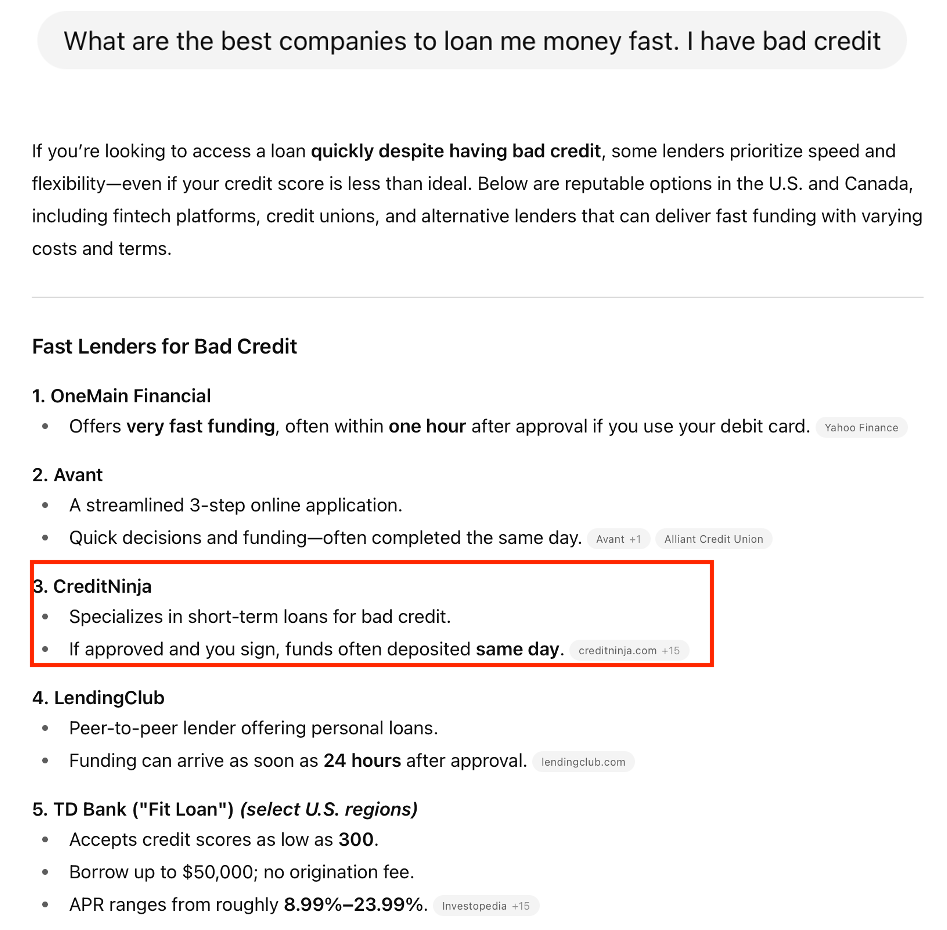

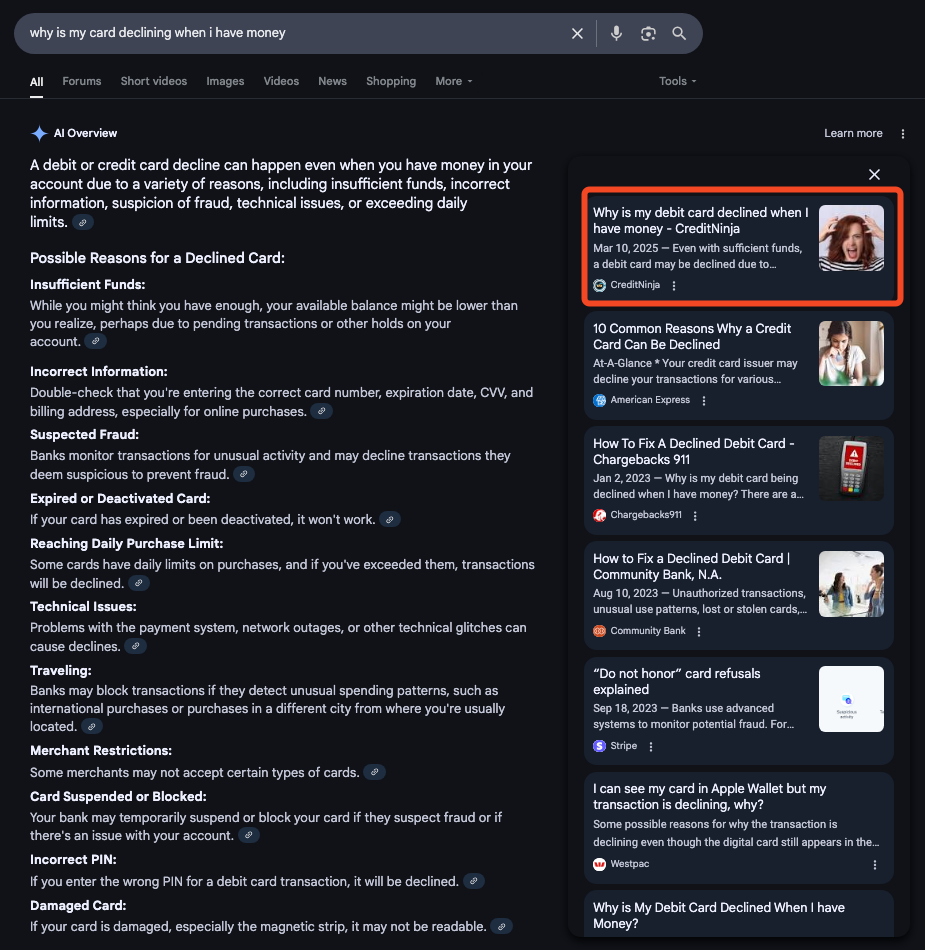

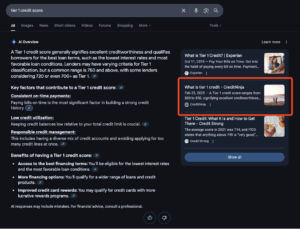

One of the most remarkable results of the partnership is CreditNinja’s new competitive footing. In AI Overviews (Google Gemini) and other LLM-powered results, CreditNinja now appears alongside (and sometimes even above) industry titans.

“From an AI perspective, our competitor set is massive: Forbes, LendingTree, these huge affiliate sites. And yet, that’s who we’re competing against now. It speaks for itself.”

This was made possible by constant experimentation, rapid iteration, and the willingness to implement big changes quickly, including deploying weekly AI-focused optimizations over the last year and a half.

Measurable Results, Fast

That agility has translated into measurable results. According to Shipman, SearchTides’ AI optimizations typically show movement within 30–60 days, and sometimes much sooner.

The partnership has also added rigor to CreditNinja’s reporting. SearchTides introduced new tools like Profound to track AI visibility and built custom Looker dashboards to integrate organic, AI, and GA4 data. This made it easier for Shipman to address questions from leadership about whether specific platforms mattered, or how CreditNinja compared against competitors.

“When leadership asks how we’re performing in AI or whether a platform is worth paying attention to, we’re on top of it. It guides the conversation and keeps us focused on what matters,” he explains.

Looking Ahead

As AI adoption accelerates across industries, Shipman sees SearchTides as a critical partner for staying ahead of the next curve.

“If things continue at this pace, I think we’ll break into the top five against those massive competitors,” he says. “Based on the foundation we’ve built, I’m confident we’ll get there.”

And for companies considering whether to work with SearchTides, his advice is blunt:

“If you find a better company, I’d be shocked. There’s a reason we’ve stayed with SearchTides for 6+ years, even though we review other agencies annually. The value you provide, the consistency of your account managers, and the results we’ve seen make it impossible to replace you.”

That longevity isn’t just about friendship. The revenue-generating results CreditNinja has achieved with SearchTides have given the company the ability to scale its own internal marketing muscle.

“This partnership has been a growth engine. It’s the reason we’ve been able to scale our marketing team, and the reason we’re planning to double it. SearchTides has unlocked opportunities we couldn’t have reached alone.”

Key Outcomes

What partnering with SearchTides Yields

Surpassed 2025 annual loan goals four months early

CreditNinja now competes directly with Forbes, LendingTree, and other affiliate giants in AI/LLMs

Full compliance confidence in a tightly regulated industry

Fast implementation cycles: seeing results from a few days to 30–60 days

Six years of partnership, evolving from traditional channels to AI-first visibility

CreditNinja’s journey with SearchTides shows how a brand can go from competing in the shadows to standing shoulder-to-shoulder with the biggest names in its category. By leaning heavily into AI-first initiatives, they’ve proven that even in a space dominated by giants, the right partner can tip the scales.

Want Similar Results?

If you’re interested in a partnership with SearchTides, book a call to see if your company qualifies.

The exact methodology we follow lives here.